Stunning Tips About How To Handle Creditors

Second, get your bankruptcy filed.

How to handle creditors. Usually, the creditors are worried that you can file for bankruptcy. Most people are automatically intimidated by their debt collectors. Complete a credit bureau dispute form.

Contact one of the major credit bureaus by phone. Submit your dispute to the credit agency, by. Contact the creditor and present the settlement offer as personal representative of the estate.

If you’re not sure the debt collector you’re dealing with is legit, here’s how to respond: When it comes to debts, you have to sort through the decedent’s mail and financial records to identify creditors, and then notify them individually as well as broadly. If your creditors accept the offer,.

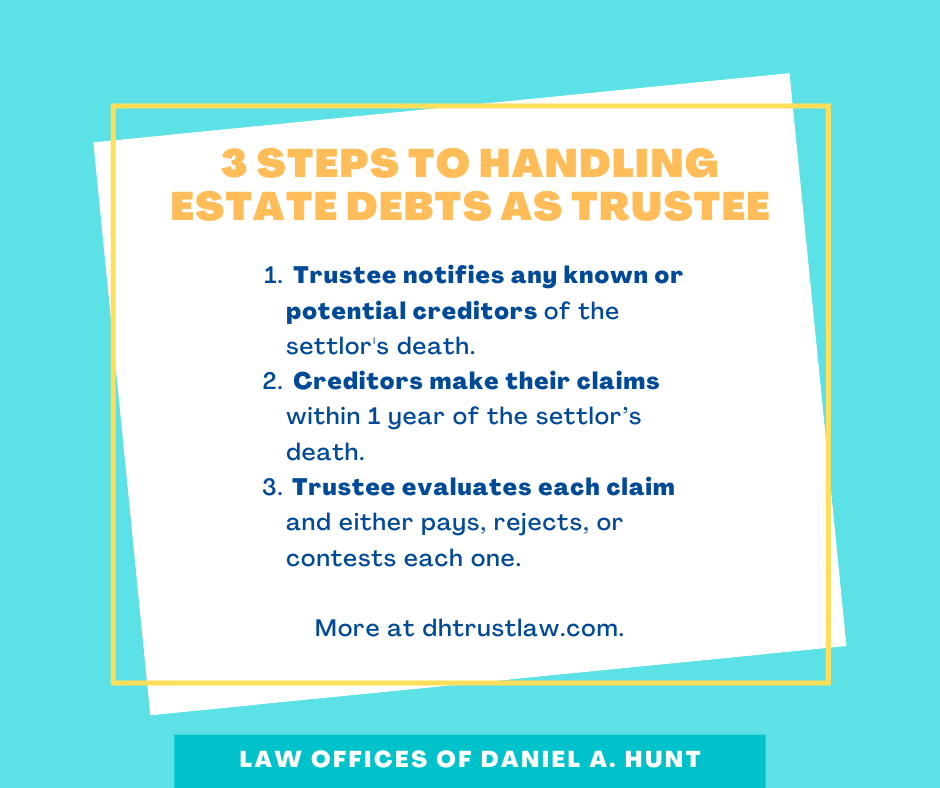

When it comes to creditors making claims on the estate in which you are the trustee or executor, it is important to work with a knowledgeable oregon estate planning. While you'll still need to send in a letter to the agency, contacting them by phone helps you prevent any fraudulent activity from. First, your executor should make reasonable efforts to notify creditors about your estate’s probate proceeding.

Get the caller’s name, company name, mailing address,. So, the best strategy is to talk to your creditor regularly and decide on alternate arrangements. Once you reach an agreement, get the settlement agreement in writing.

Avant could be a great choice if you have bad credit or a low credit score, and it can fund loans as soon as the next business day (if approved by 4:30 p.m. First, get the assistance of a skilled georgia bankruptcy attorney. The personal representative must respond to all claims in writing.