Glory Tips About How To Avoid Insufficient Capital

First, stretch out the achievement of strategic goals and reallocate resources to bolster human capital capabilities.

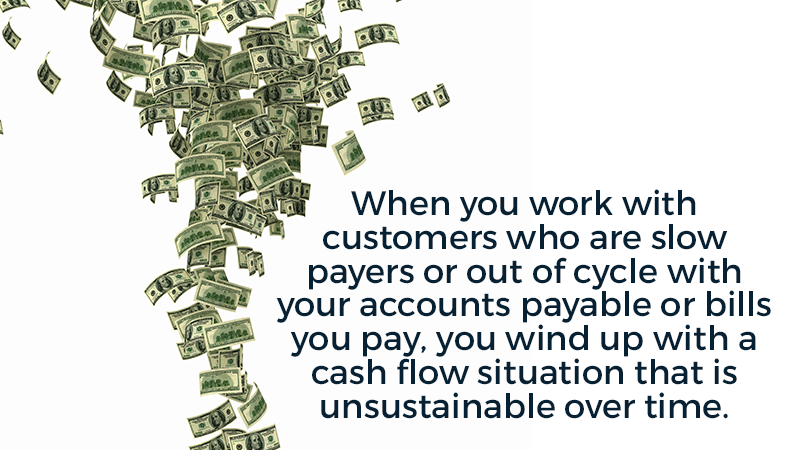

How to avoid insufficient capital. An increased cash flow generates working capital. An insufficient funds fee is charged by the bank as a penalty when a payment presented by check is refused due to insufficient funds. This provides the organization the opportunity to catch up and regain a.

There are numerous strategies that investors can implement to reduce or avoid capital gains tax on stocks sold at a profit. We want to avoid the need for a capital call in the case of construction cost overruns. Taxpayers facing a penalty for underpayment of estimated tax last year, the internal revenue service urges.

Reconcile the checking account frequently and keep track of balances. Below are six strategies to improve insufficient working capital. One of the options you can consider when it comes to securing funds for your business is a working capital loan.

In the u.s., the fee is from $27 to $35. Receive late or partial payments from those new customers. To avoid capital gains tax on the sale of a rental property, it is possible to defer capital gains tax under section 1031 of the internal revenue code.

Focus on strong balance sheets. Inadequate resources from the start. Hospital management teams should be aware of and prepared to avoid eight key problems for healthcare capital projects:

Options for meeting working capital needs. Avoid financing fixed assets with working capital. Here are a few of the most common methods that.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)