Fun Tips About How To Sell Accounts Receivable

How accounts receivable funding works.

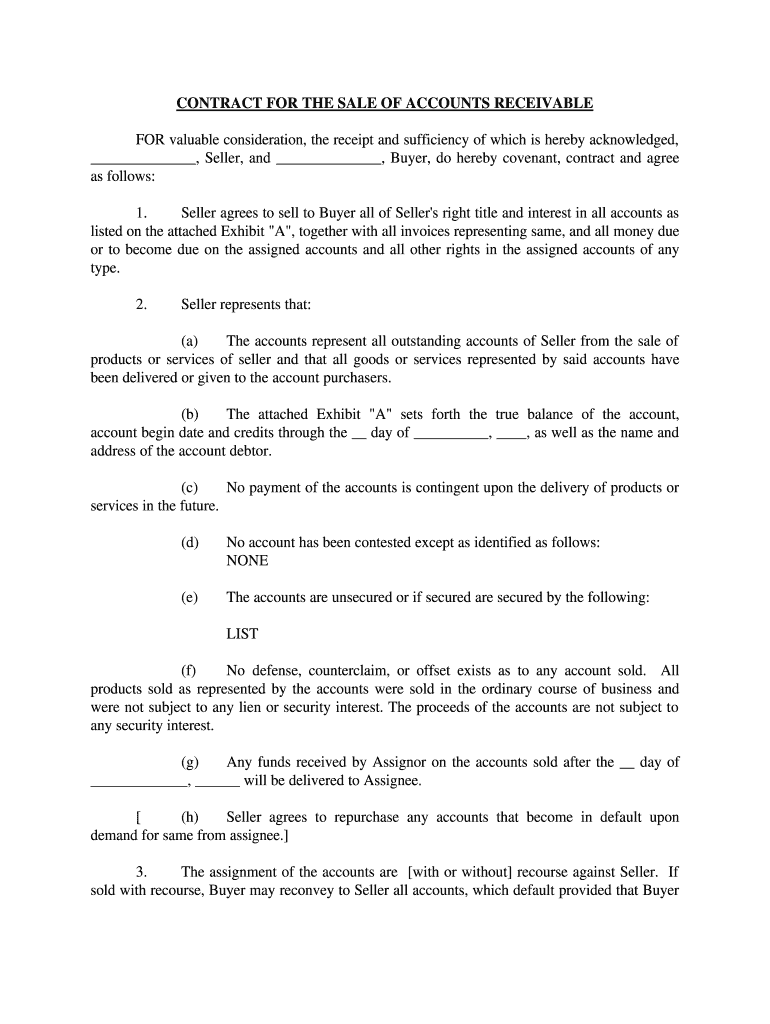

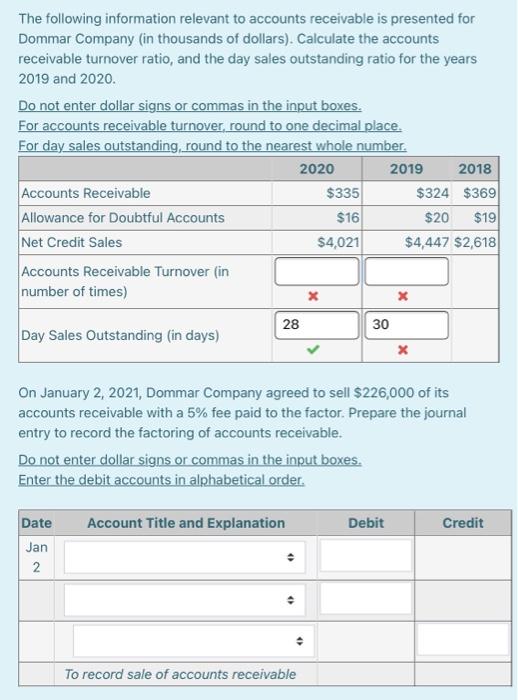

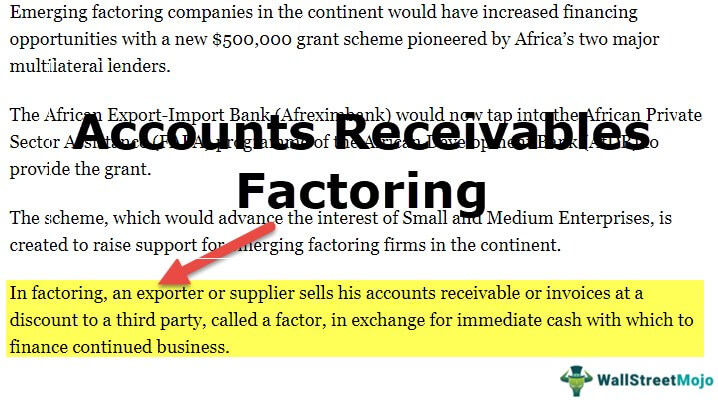

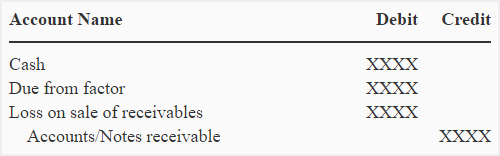

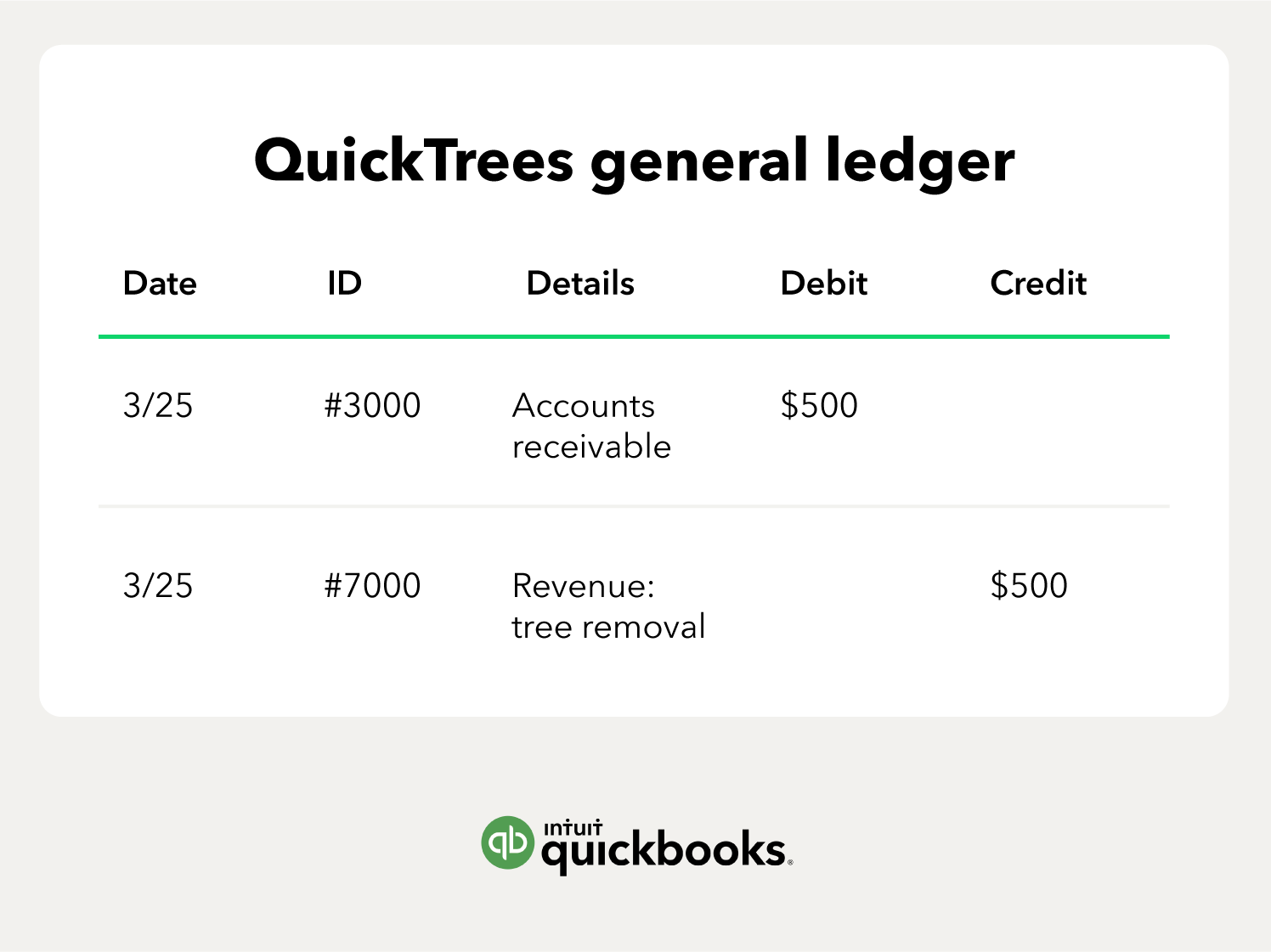

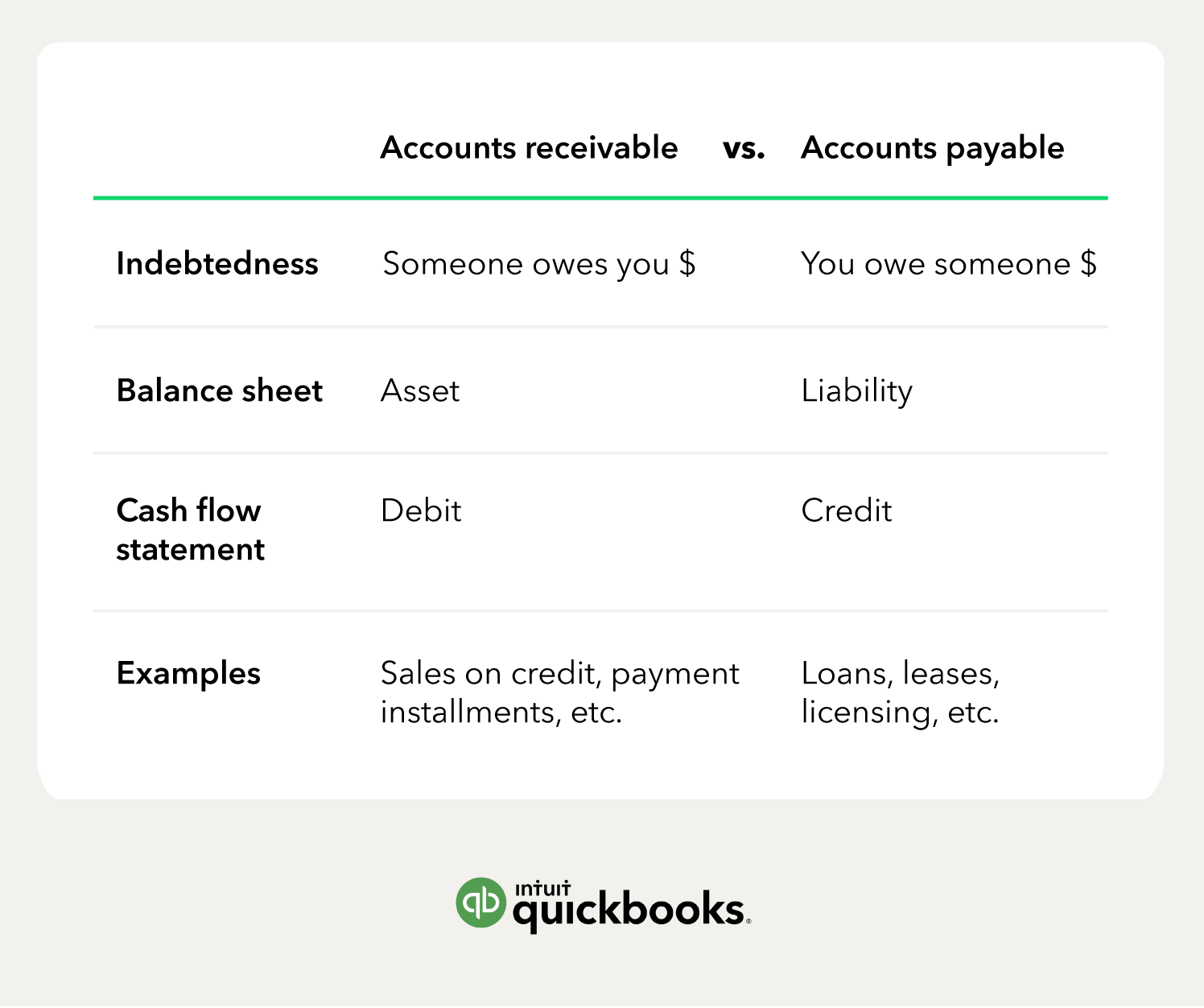

How to sell accounts receivable. Accounts receivable financing, also known as invoice factoring, allows your business to sell open invoices to a factoring company. Accounts receivable turnover ratio = net credit sales / average accounts receivable. Once you qualify for invoice factoring, you can choose.

You complete a quick application and after approval sign a. Typically, it boils down to four simple steps: The factor buys the receivables at a discount,.

You don’t have to be the banker for your customers. Business must meet the minimum criteria to sell accounts receivable on the auction site. Although opinions are divided on selling accounts receivable (a/r), a strong argument for “yes” is that it’s a good idea if both parties agree and the price is carefully evaluated.

The formula for calculating the accounts receivable turnover ratio is: The process is relatively simple, and the first invoice can usually be purchased in a few days. Total the starting and ending receivables for a certain time period.

If your company is in a period of rapid growth and needs cash quick, factoring could be the solution. Selling receivables is a fast financing process that takes 3 to 5 days from applying. Selling your accounts receivable accounts receivable to us will get you the cash you need and provide relief to your customers too.

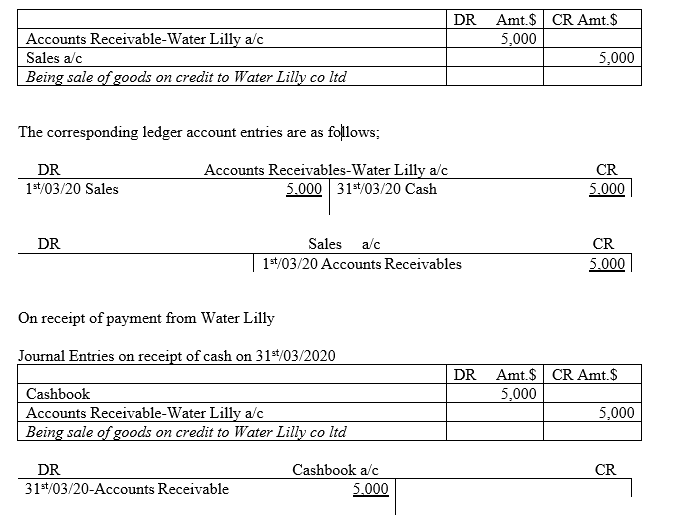

Doing so is accomplished by selling them to a third party in exchange. When services are sold to a customer, the seller normally creates an invoice in its accounting software, which automatically creates an entry to credit the sales account and. Accounts receivable turnover calculation make a calculation of your average balance.

![Chapter 5: Sales Revenue And Accounts Receivable - How To Read A Financial Report: Wringing Vital Signs Out Of The Numbers, 8Th Edition [Book]](https://www.oreilly.com/library/view/how-to-read/9781118735589/images/f044-01.jpg)

/accounts-receivable-4202182-final-d52a491a07244f3b8544903ebeaf8be4.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)